Understanding Debt: The Importance of a Plan

Debt is an intrinsic part of many individuals’ financial lives, often arising from essential purchases such as homes, education, or vehicles. While some debt can be deemed “good” due to its potential to enhance one’s quality of life or generate income, uncontrolled or excessive debt can significantly hinder personal financial stability. Managing debt effectively necessitates a structured plan that enables individuals to not only pay off what is owed but also to cultivate a healthier financial future.

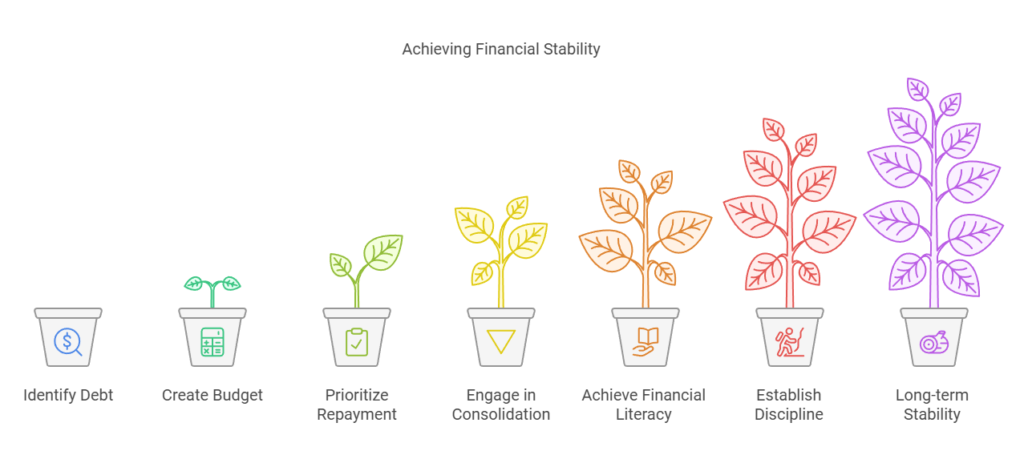

A well-defined debt management plan is critical in identifying the types and amounts of debt one is dealing with. Without a clear understanding of the debts owed, individuals may find themselves overwhelmed, which can lead to neglecting payments and further compounding financial difficulties. Adopting strategies such as creating a budget, prioritizing debt repayment, or engaging in debt consolidation can enhance an individual’s ability to regain control of their finances. As financial author and speaker Suze Orman remarked, “The key to financial success is to pay off debt and maintain your credit.” This underscores the significance of having a clear path toward debt resolution.

Personal accounts of triumph over debt illustrate the power of effective planning. One individual, who had accumulated expenses due to unexpected medical bills, decided to adopt a rigorous repayment plan. By strictly budgeting and prioritizing expenditures, they managed to reduce their debt by over 60% in just two years. Such experiences reinforce the notion that a disciplined approach, combined with support and well-defined goals, can transform the trajectory of one’s financial life.

Establishing a financial plan not only aids in debt repayment but also fosters financial literacy and self-discipline. These elements lay the foundation for sustainable financial behaviors that contribute to long-term stability. Therefore, anyone grappling with financial obligations should recognize the importance of a structured strategy in managing and ultimately overcoming their debt challenges.

Effective Strategies for Paying Off Debt

Paying off debt can often feel overwhelming, but implementing proven strategies can simplify this daunting task. Two popular approaches are the avalanche method and the snowball method, each differing in its approach and potential for long-term success. The avalanche method focuses on paying off debts with the highest interest rates first, minimizing the total interest paid over time. This not only accelerates the debt repayment process but also saves money in interest charges. On the other hand, the snowball method emphasizes paying off smaller debts first, providing quick wins that can motivate individuals to continue tackling larger debts. While both methods effectively reduce debt, choosing one depends on personal preference and psychological motivation.

Another effective option is debt consolidation, which involves combining multiple debts into a single loan with a lower interest rate. This simplifies payments and can lower monthly payments, making it easier for individuals to manage their finances. Consolidation may come in various forms, including personal loans or balance transfers to credit cards with promotional rates. Such approaches not only streamline repayment but can also reduce the total interest burden, allowing individuals to pay off debts faster.

For some, seeking professional help from financial advisors or credit counseling services may be necessary. These professionals can provide tailored strategies that suit individual circumstances, facilitate negotiations with creditors, and assist in budgeting. Personal anecdotes reveal how individuals who sought such assistance saw substantial improvements in their financial status, allowing them to eliminate debt more effectively.

The journey to financial freedom requires determination and persistence. As financial experts emphasize, remaining committed to a chosen strategy is vital for success. Individuals can conquer their debts and achieve financial stability through effective planning and the right resources.

Building Financial Discipline: Habits for Success

Cultivating financial discipline is paramount in the journey towards debt management and securing a stable financial future. Individuals often find that evading the pitfalls of debt relies heavily on establishing and adhering to specific habits that foster responsible financial choices. One of the most effective strategies is implementing a comprehensive budgeting plan. This plan should track income and expenses meticulously, allowing you to pinpoint areas where unnecessary spending can be minimized. By doing so, you not only direct funds toward debt repayment but also establish a clearer understanding of your financial landscape.

In addition to budgeting, the practice of saving cannot be overstated. Setting up an emergency fund, even a modest one, can act as a financial buffer against unexpected expenses that could derail your debt repayment efforts. Individuals who have experienced success in managing their finances often share stories of how prioritizing savings transformed their financial habits. For instance, a person who decided to allocate a portion of every paycheck towards savings instead of discretionary spending found themselves less prone to impulsive purchases, leading to a more secure financial status over time.

Moreover, embracing smarter financial choices can create lasting impacts. Educating oneself on financial literacy, seeking advice, and utilizing tools such as expense tracking apps can empower individuals to make informed decisions. As motivational speaker Tony Robbins once stated, “Discipline is the bridge between goals and accomplishment.” Committing to this discipline can lead to sustained financial health, ensuring that individuals not only pay off their debts but also build a foundation for future financial success. By integrating these habits into your daily routine, you position yourself on a path toward a debt-free lifestyle.

Staying Motivated: Celebrating Small Wins

Embarking on a debt repayment journey can often feel like a daunting task, fraught with challenges and setbacks. Therefore, maintaining motivation throughout this process is essential for enduring success. One effective method to keep morale high is by celebrating small milestones along the way. Recognizing these incremental achievements can foster a sense of progress and motivate individuals to stay committed to their financial goals.

Tracking progress is a crucial part of this motivational strategy. Individuals can utilize budgeting apps, debt calculators, or even a simple spreadsheet to monitor their repayment schedules and see how far they have come. It is important to note the smaller milestones, such as paying off a specific amount of debt, sticking to a budget for a certain period, or eliminating a minor debt completely. Each of these targets can be seen as a stepping stone toward financial freedom.

Moreover, rewarding oneself for these achievements can enhance the overall experience of debt repayment. Setting aside a small reward—such as a favorite treat, an inexpensive outing, or a day of relaxation—after reaching a predetermined goal can cultivate a positive association with the process. Personal stories illustrate the power of this approach. For instance, an individual named Lisa successfully paid off her credit card debt by celebrating every payment milestone with a small gift, enabling her to stay motivated through the toughest months.

Additionally, incorporating uplifting quotes from respected figures can inspire one to remain steadfast. For instance, the motivational words of Maya Angelou, “Nothing will work unless you do,” reiterate the importance of perseverance. Such affirmations, combined with acknowledgment of small victories, create a resilient mindset that will empower individuals on their journey to financial stability. By focusing on progress rather than perfection, debt repayment can transform into a more enriching experience.

Pingback: Financial Security 101: Why You Need an Emergency Fund

Pingback: Should You Rent or Buy a Home in Today's Market? - Finance Snapshot

Pingback: Debt Consolidation: Is It the Right Move for You? - Finance Snapshot

Well I sincerely liked studying it. This tip procured by you is very effective for proper planning.