Like many of you, Sarah started her career buried in student debt and living paycheck to paycheck. “I was always anxious about money,” she recalls. “Every unexpected expense felt like a crisis.” But through dedication and smart money management, she transformed her financial life. Today, Sarah has a healthy emergency fund, investments for retirement, and the peace of mind that comes with financial security. Her journey inspired me to share these practical tips that can help anyone take control of their financial future.

Start With Clear Financial Goals

Warren Buffett once said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” This wisdom perfectly captures the importance of setting clear financial goals. Whether you’re saving for a down payment, planning for retirement, or building an emergency fund, specific goals give your financial journey direction and purpose.

Begin by writing down your short-term (1 year), medium-term (2-5 years), and long-term (5+ years) financial goals. Make them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of “save more money,” try “save $5,000 for an emergency fund by December 2025.”

Master the Art of Budgeting

The foundation of financial success is understanding where your money goes. Start by tracking every expense for a month – you might be surprised by what you discover. Sarah found she was spending over $200 monthly on subscription services she barely used.

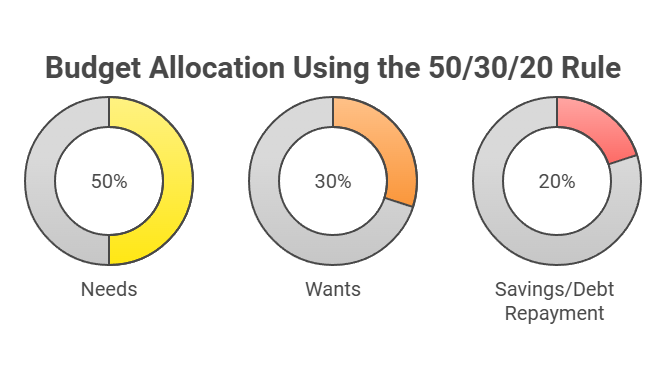

Create a realistic budget using the 50/30/20 rule:

- 50% for needs (housing, utilities, groceries)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt repayment

Build Your Safety Net

As personal finance expert Suze Orman notes, “A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.” An emergency fund is your first line of defense against financial surprises. Aim to save 3-6 months of living expenses in an easily accessible account.

Smart Investing for the Future

Investing doesn’t have to be complicated. Start with your employer’s retirement plan if available, especially if they offer matching contributions – that’s free money! Consider low-cost index funds for long-term wealth building. Even small, regular investments can grow significantly over time thanks to compound interest.

Tackle Debt Strategically

Not all debt is created equal. Prioritize paying off high-interest debt first while maintaining minimum payments on other obligations. Sarah tackled her debt using the snowball method – paying off smallest debts first for quick wins that kept her motivated.

Automate Your Finances

Make technology work for you. Set up automatic transfers for savings, bill payments, and investments. This removes the temptation to spend money earmarked for important goals and ensures you never miss a payment.

Live Below Your Means

The key to building wealth isn’t earning more – it’s spending less than you earn. Look for practical ways to reduce expenses without sacrificing quality of life. Sarah saved thousands by meal planning, using cashback apps, and finding free entertainment options in her community.

Continuously Educate Yourself

Financial literacy is a journey, not a destination. Stay informed about personal finance through books, podcasts, and reputable online resources. Knowledge gives you confidence to make better financial decisions.

Take Action Today

Your financial future starts with the decisions you make today. Begin with one small step – track your spending for a week, set up an automatic savings transfer, or review your subscriptions. Remember, the goal isn’t perfection but progress.

As Sarah’s story shows, financial security is achievable with patience and dedication. The best time to plant your financial tree was yesterday. The second best time is now.

Ready to take control of your finances? Start by choosing one tip from this post and implementing it this week. Share your commitment in the comments below, and let’s support each other on the journey to financial freedom.

What financial goal will you tackle first?

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.